Outbound calling and text messaging remain powerful channels for customer acquisition across insurance, home services, solar, and financial services—but only if they’re backed by airtight compliance.

In 2025, the biggest risk many enterprises face isn’t from outdated technology—it’s from the rise in TCPA litigation.

As professional plaintiffs increasingly exploit gaps in outbound lead processes, platforms like DNC.com have become essential for mitigating risk.

Their real-time scrubbing, litigation defense tools, and verification infrastructure help enterprises stay compliant before the first call is even made.

These lawsuits don’t always come from frustrated consumers. Increasingly, they’re filed by professional plaintiffs—individuals who deliberately set traps for businesses and exploit technical slip-ups for financial gain.

For enterprises that depend on outbound leads, this is a ticking time bomb: a single bad lead can trigger lawsuits costing millions.

The good news? With the right compliance infrastructure in place, businesses can stay off the radar of professional litigators while protecting both their revenue and their reputation.

1. The Rising Tide of TCPA Litigation

TCPA litigation has exploded in 2025:

- 507 TCPA class actions were filed in Q1 2025 alone, a 112% increase from the same quarter in 2024 (NatLawReview).

- By mid-year, filings climbed to 1,714, up 31% year-over-year (DNC.com).

- Between January and April, 880 new TCPA cases were reported—a 44% increase compared to 2024 (CompliancePoint).

Even more troubling, roughly 80% of all TCPA filings are now class actions. That means even a handful of questionable calls can snowball into massive litigation.

2. The Real Costs of Non-Compliance

The penalties under TCPA are steep—and they add up quickly:

- $500–$1,500 per violation depending on intent (DNC.com).

- $61 million verdict against a satellite TV provider over calls to 18,000 numbers on the DNC list—caused by a vendor error (DNC.com).

- $6.6 million average settlements across TCPA cases (DNC.com).

- Blue Cross paid $1.6 million in 2025 to settle TCPA claims (TCPAWorld).

- JPMorgan Chase paid $34 million in a separate settlement (Leadshook).

Beyond fines, the hidden costs include:

- Legal fees for months (or years) of defense.

- Damaged brand reputation, especially in consumer markets.

- Lost opportunity, as leadership shifts focus from growth to litigation.

3. Why This Happens: The Litigation Trap

Most TCPA lawsuits aren’t the result of intentional bad actors. They’re triggered by gaps in compliance systems:

- A vendor supplies a bogus lead, claiming consent that never existed.

- A reassigned number gets called, even though it once belonged to someone who gave consent.

- Calls placed outside permitted hours (before 8am or after 9pm) (NatLawReview).

- A predictive dialer autodials a mobile number without proper consent.

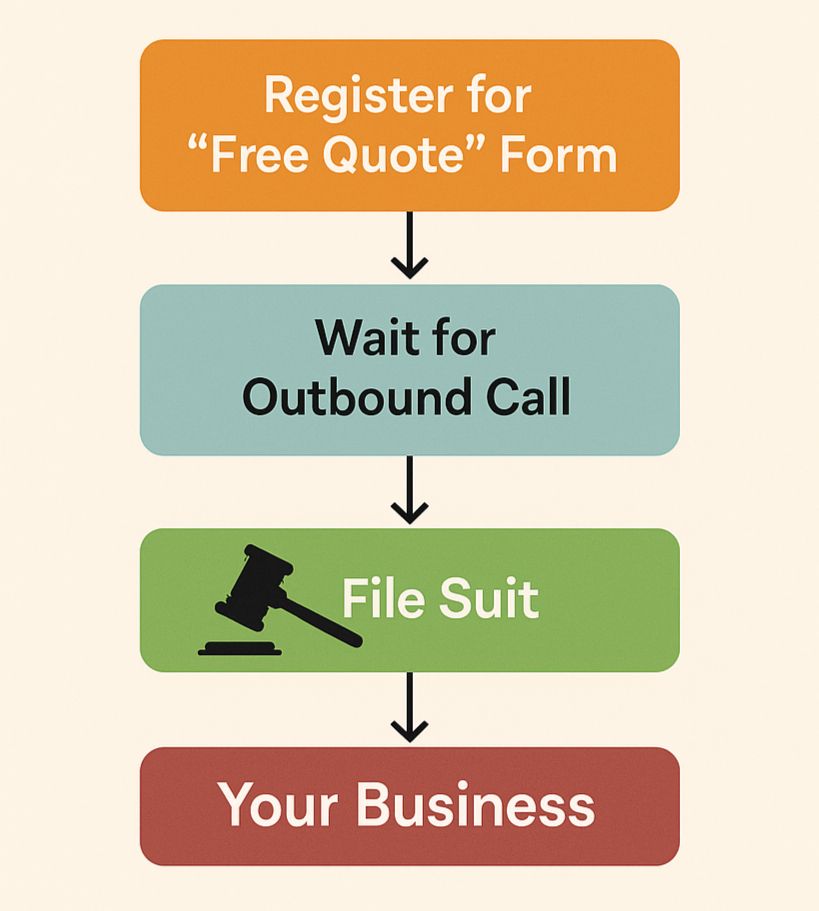

Professional plaintiffs look for these cracks. They register for “free quote” forms, wait for an outbound call, and then file suit if compliance boxes weren’t ticked. It’s a business model for them—and a liability trap for you.

4. Building a Compliance Shield

The only effective defense is prevention through automation. That means building compliance into every outbound workflow, not hoping to fix issues later.

Key components of a compliance shield include:

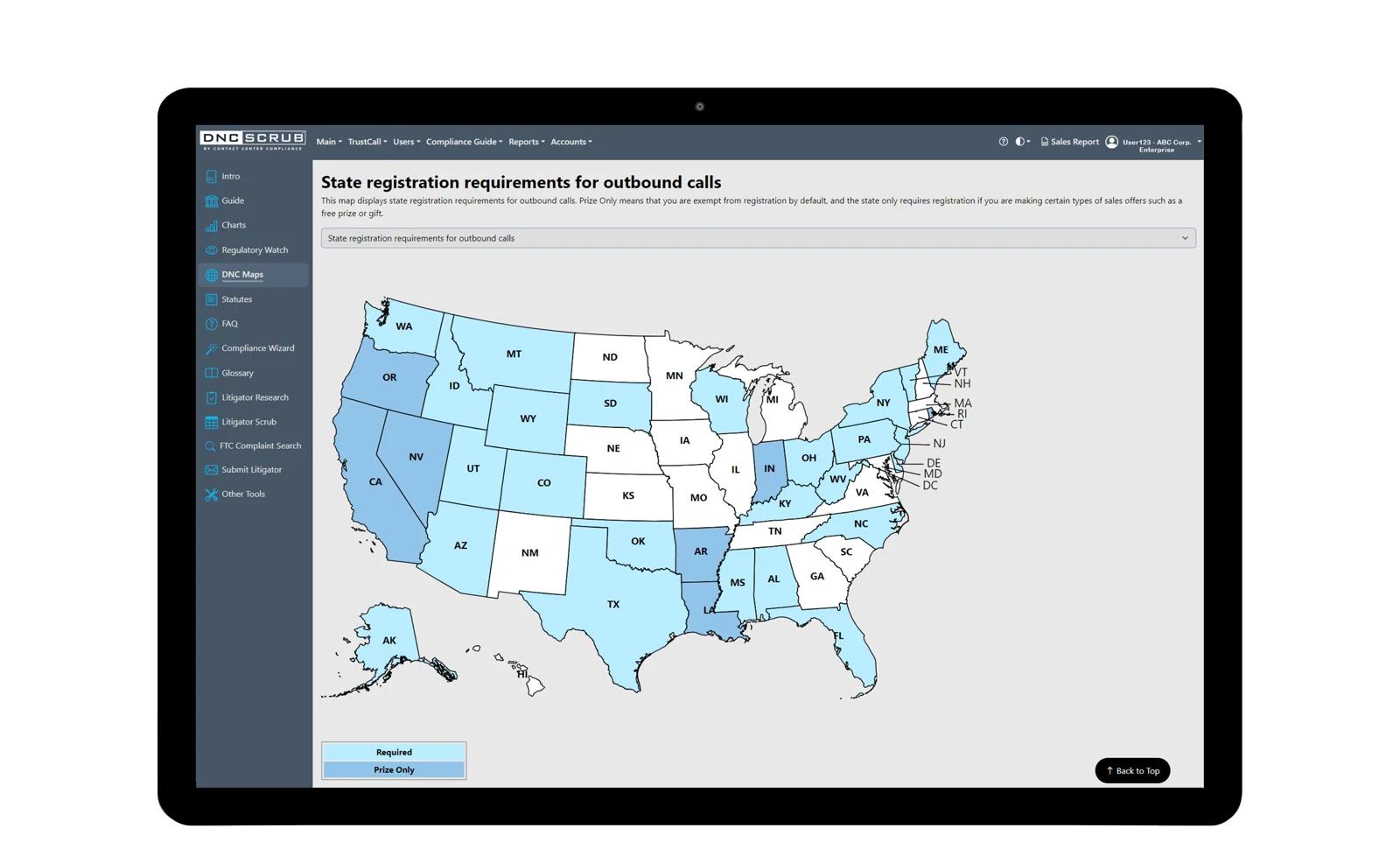

- DNC List Scrubbing: Checking national, state, and internal Do Not Call lists.

- Litigator Scrub®: Removing numbers tied to known TCPA plaintiffs.

- Wireless Identification: Detecting mobile vs. landline to avoid illegal auto-dials.

- Reassigned Number Database (RND) Checks: Avoiding wrong-party calls.

- Time-of-Day Restrictions: Enforcing safe calling hours automatically.

- Consent Documentation: Keeping audit-ready proof of every consumer’s opt-in.

Solutions like DNC.com provide these safeguards in real time, ensuring every lead is safe to contact before the first dial.

5. Why This Matters for Lead Buyers

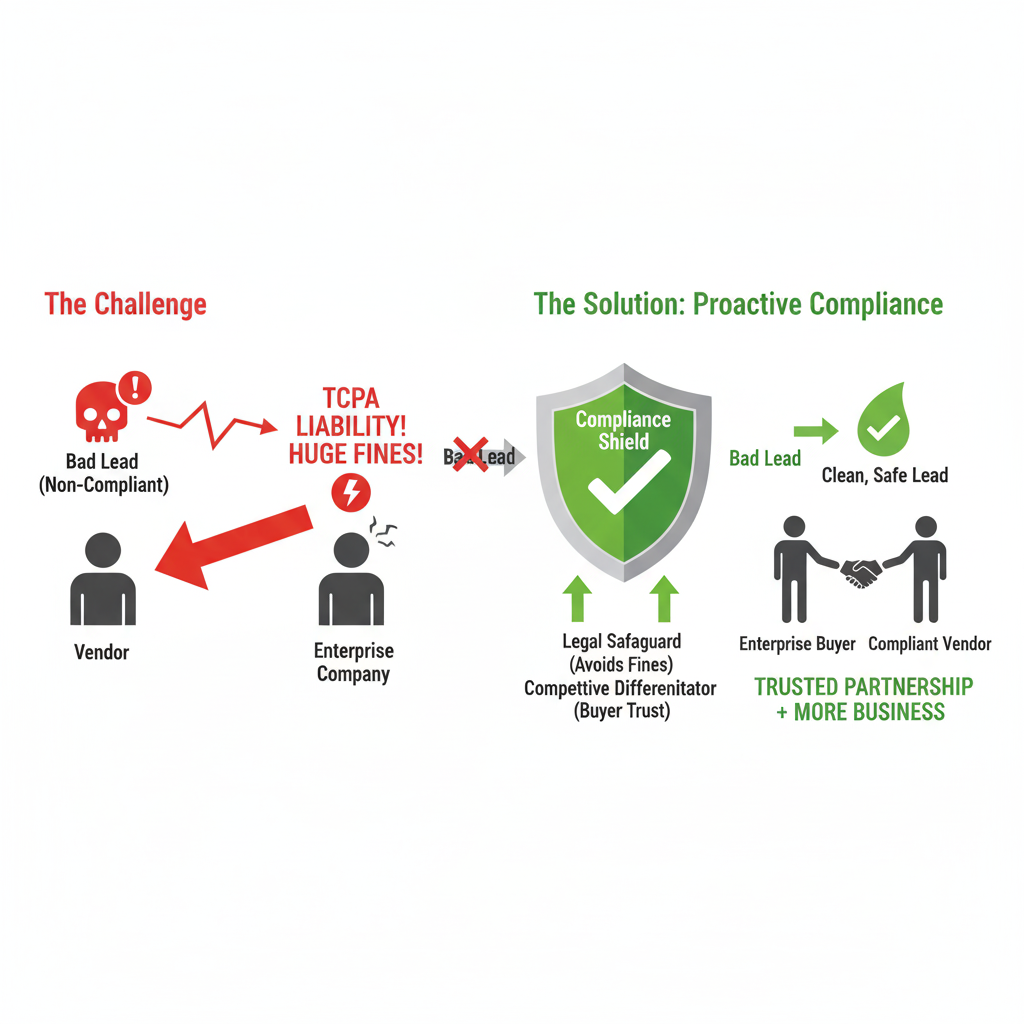

The challenge compounds when enterprises buy leads from vendors. Even if your systems are compliant, a single bad lead from a vendor exposes your company—not the vendor—to TCPA liability.

That’s why proactive compliance is both:

- A legal safeguard: protecting against massive fines.

- A competitive differentiator: buyers increasingly demand proof that leads are scrubbed and safe.

This trust strengthens partnerships. Sellers that can prove compliance win more business and maintain longer-term buyer relationships.

6. Closing the Loop: From Insight to Execution

Compliance data is most powerful when it connects directly to lead distribution.

In a modern ping-post system, compliance signals can be baked into routing rules. Leads flagged as risky (e.g., missing consent, potential litigator) are blocked automatically. Leads verified as safe are routed, priced, and delivered instantly.

This integration—combining compliance safeguards like DNC.com with distribution platforms such as Standard Information—creates a closed loop. Every lead is checked, scored, routed, and monetized without exposing companies to unnecessary risk.

7. The Enterprise Benchmark

In 2025, enterprise contact centers and lead buyers should benchmark themselves against three core questions:

- Can we prove consent for every lead we contact?

- Are we scrubbing in real time against DNC, wireless, and litigator databases?

- Do our distribution systems act on compliance data instantly, without manual steps?

If the answer is “no” to any of these, the system is incomplete—and the organization remains exposed.

Enterprises that can answer “yes” to all three not only reduce risk, but also win buyer trust, protect margins, and avoid the operational drag of lawsuits.

8. The Payoff: Smarter, Safer Growth

Proactive compliance delivers more than protection:

- 5–10% fewer wasted calls, by removing bad numbers before dialing.

- Millions in avoided liability, especially at enterprise scale.

- More efficient sales cycles, since agents spend less time on risky leads.

- Stronger buyer trust, creating long-term contracts and revenue stability.

In short: compliance doesn’t just keep companies out of court. It makes them more profitable.

9. Conclusion: Stay Off the Radar

TCPA litigation is no longer an occasional nuisance. It’s a strategic industry for professional plaintiffs. For businesses dependent on outbound contact, the risk of frivolous suits has never been higher.

But with the right infrastructure—scrubbing leads in real time, filtering litigators, validating wireless numbers, and documenting consent—enterprises can stay off the radar of opportunistic plaintiffs.

Compliance doesn’t just protect. It differentiates. It strengthens buyer relationships. It ensures every lead called is safe, compliant, and profitable.

Platforms like DNC.com demonstrate how modern compliance works in practice. And when paired with intelligent distribution systems such as Standard Information, compliance isn’t just a safeguard—it becomes a growth lever.

In the battle between frivolous lawsuits and sustainable growth, prevention always wins.